Comprehensive Healthcare Management Solutions with Lifeline TPA: Your Trusted Partner in UAE

Understanding the complexities of healthcare insurance administration requires expertise, dedication, and a commitment to excellence. In today’s dynamic healthcare landscape, having a reliable third-party administrator becomes essential for individuals and organizations seeking seamless insurance management solutions. The healthcare sector in the United Arab Emirates has witnessed tremendous growth, creating an increasing demand for professional administrative services that bridge the gap between insurance providers and healthcare consumers.

When searching for reliable lifeline insurance uae services, policyholders and healthcare providers alike need a partner that understands the intricate requirements of modern healthcare administration. The integration of technology with traditional insurance management has revolutionized how claims are processed, networks are managed, and customer satisfaction is delivered. This transformation has positioned specialized administrators as crucial intermediaries in the healthcare ecosystem, ensuring that every stakeholder receives optimal value from their insurance investments. The commitment to excellence in service delivery has made professional third-party administrators indispensable in managing the complexities of healthcare coverage across diverse populations.

Building Strong Healthcare Networks Across Emirates

Healthcare networks form the backbone of effective insurance administration, providing policyholders with access to quality medical facilities. A comprehensive lifeline network list encompasses hospitals, clinics, pharmacies, diagnostic centers, and specialty care providers across multiple emirates. The strategic development of provider networks ensures that insured members can access cashless healthcare services at conveniently located facilities. Network expansion involves rigorous credentialing processes, quality assessments, and ongoing relationship management to maintain service standards.

The geographical distribution of network providers plays a vital role in ensuring accessibility, particularly in regions where healthcare infrastructure continues to develop. Strategic partnerships with leading healthcare institutions enhance the value proposition for policyholders while maintaining cost-effectiveness for insurance companies. From bustling metropolitan areas to emerging communities in the Northern Emirates, network coverage ensures that quality healthcare remains accessible to all insured members regardless of their location. This extensive network foundation supports the diverse healthcare needs of UAE’s multicultural population.

Streamlined Claims Processing and Documentation

Claims processing represents one of the most critical aspects of insurance administration, requiring accuracy, efficiency, and transparency. The lifeline claim form submission process has been designed with user convenience in mind, incorporating digital solutions that reduce processing time while maintaining rigorous verification standards. Modern claims management systems utilize intelligent adjudication rules that automatically process a significant portion of claims without manual intervention, ensuring faster reimbursements and improved member satisfaction. The transparency in claims handling builds trust between insurers, administrators, and policyholders.

Documentation requirements for claims submission have been simplified to minimize administrative burden on healthcare providers and patients. Clear guidelines regarding required documents, submission timelines, and approval processes ensure that all stakeholders understand their responsibilities. The implementation of advanced technology platforms allows for real-time claim tracking, providing visibility into claim status at every stage of processing. This technological integration reduces errors, prevents fraud, and accelerates the overall claims cycle from submission to settlement, ultimately enhancing the experience for all parties involved.

Professional Third-Party Administration Excellence

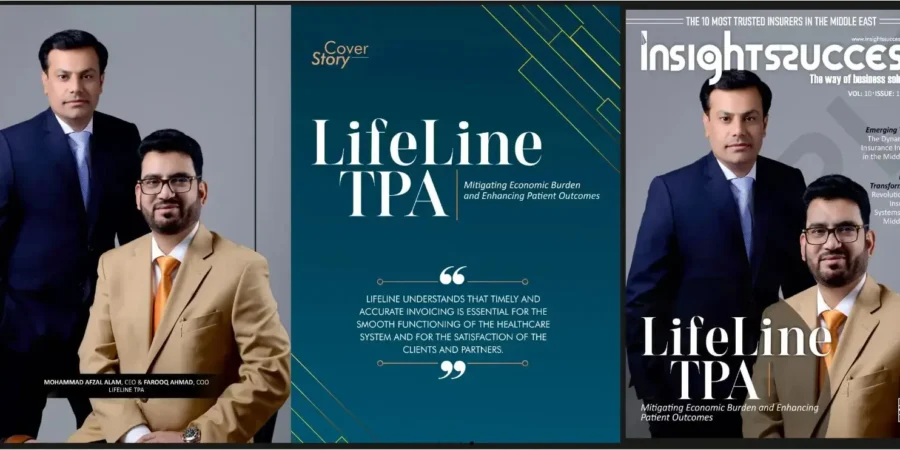

Understanding what lifeline tpa represents in the healthcare ecosystem is essential for appreciating the comprehensive services provided. As a licensed third-party administrator operating since 2015, the organization specializes in managing health insurance claims, policy administration, member enrollment, and provider network coordination. The expertise spans across UAE, Oman, and Turkey, demonstrating a regional presence that supports diverse healthcare systems and regulatory environments. This geographical reach enables the handling of cross-border healthcare requirements and international treatment coordination.

The core competencies include claims settlement, record-keeping, plan maintenance, and risk management support for insurance companies. Professional medical teams with expertise across various specialties ensure that clinical aspects of claims are properly evaluated. Continuous staff training programs maintain high service standards while keeping pace with evolving healthcare practices and insurance regulations. The commitment to transparency, effective fraud controls, and member-centric service delivery distinguishes professional administration from generic processing services. This specialized focus on healthcare administration enables insurance companies to concentrate on their core underwriting and risk management functions.

Comprehensive Service Portfolio for Diverse Needs

The service offerings extend beyond basic claims processing to include preferred provider network development, policy and member enrollment management, overseas assistance coordination, and customer service excellence. Individual health insurance plans cater to personal coverage needs while corporate group plans address employer requirements for workforce protection. The Northern Emirates health insurance management demonstrates specialized capability in serving regions with unique regulatory frameworks and healthcare infrastructure characteristics.

Wellness programs complement traditional insurance administration by promoting preventive care and healthy lifestyle choices among insured populations. Digital platforms including member portals and mobile applications provide convenient access to policy information, network directories, claim status updates, and health management tools. These technological solutions reflect the modernization of healthcare administration while maintaining the personal touch through 24/7 customer support helplines. Emergency services coordination ensures that critical healthcare needs receive immediate attention regardless of time or location.

Strategic Partnerships and Industry Collaboration

Building successful insurance ecosystems requires collaboration with multiple stakeholders including insurance companies, healthcare providers, brokers, and corporate clients. Strategic alliances with leading insurance partners demonstrate trust and reliability in service delivery. The roster of insurance collaborators includes established names in the UAE insurance market, reflecting the credibility earned through consistent performance and professional service standards. These partnerships enable customized plan development that addresses specific market segments and demographic needs.

Provider relationship management involves continuous quality monitoring, contract negotiation, rate management, and service level compliance verification. The balance between network breadth and quality control ensures that insured members access appropriate care at reasonable costs. Regular provider education programs align network facilities with insurance plan requirements and claims processing procedures. This collaborative approach creates synergies where administrative expertise complements insurance underwriting capabilities and healthcare delivery excellence, ultimately benefiting the end consumers through improved access and service quality.

Technology-Driven Administrative Solutions

Modern insurance administration relies heavily on robust technology platforms that integrate various operational functions. Advanced management systems handle member enrollment, eligibility verification, authorization processing, claims adjudication, and financial reconciliation through unified databases. The automation of routine processes reduces human error while freeing staff to focus on complex cases requiring professional judgment. Data analytics capabilities provide insights into utilization patterns, cost trends, and quality indicators that inform decision-making for all stakeholders.

Security measures protect sensitive health and financial information in compliance with data protection regulations. Cloud-based solutions ensure system reliability and disaster recovery capabilities while supporting remote access for distributed teams. Mobile technology enables field operations including pre-authorization verification at provider locations and member service during treatment. The investment in technological infrastructure demonstrates commitment to operational excellence and readiness for future healthcare administration challenges including telemedicine integration and artificial intelligence applications in claims processing.

Customer Service Excellence and Member Support

Round-the-clock customer service availability through dedicated helplines ensures that members receive assistance whenever needed. Multilingual support teams accommodate the diverse linguistic needs of UAE’s international population. Query resolution processes prioritize accuracy and responsiveness, with clear escalation paths for complex situations. The customer service philosophy emphasizes empathy, patience, and problem-solving rather than mere transactional interactions, recognizing that healthcare matters often involve stress and urgency.

Member education initiatives help policyholders understand their coverage, rights, and responsibilities. Orientation programs for newly enrolled groups ensure smooth onboarding and minimize confusion during initial policy usage. Feedback mechanisms including complaint management systems demonstrate accountability and continuous improvement commitment. Regular satisfaction surveys gauge service quality and identify enhancement opportunities. This member-centric approach transforms administrative functions from backend operations into value-adding services that enhance the overall insurance experience.

Future Vision and Industry Leadership

The healthcare insurance landscape continues evolving with regulatory changes, technological innovations, and shifting consumer expectations. Maintaining industry leadership requires adaptability, innovation, and unwavering commitment to service excellence. Future directions include expanding digital self-service capabilities, incorporating predictive analytics for proactive member care, and developing specialized programs for chronic disease management. The vision encompasses becoming a regional benchmark for third-party administration through consistent delivery of superior outcomes for all stakeholders.

Sustainability in operations involves balancing efficiency gains with quality maintenance, cost optimization with network adequacy, and technological advancement with human touch preservation. Environmental consciousness in office operations and paperless processing initiatives reflect corporate responsibility beyond core business functions. The aspiration extends beyond transactional administration toward becoming trusted healthcare partners who contribute positively to population health outcomes while supporting the financial sustainability of insurance programs across the region.

Leave a Reply